We Solve the Two Biggest Financial Problems People Have: Living too long, or dying too soon- financially!

Choose a vibrant image and write an inspiring paragraph about it.

It does not have to be long, but it should reinforce your image.

The Scam

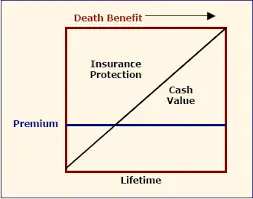

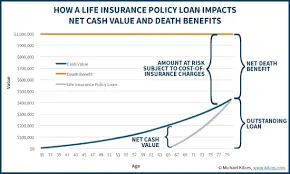

With Whole Life you pay a level premium for a level death benefit to age 100. You're paying for two things: cash accumulation, AND death protection- but you, your family, or business only get one or the other (Universal Life and IUL costs less-because it expires or lapses without value at 75!). You can access Cash Value ONLY by Surrendering the Contract- thereby canceling your death protection; OR you may Take a Loan against the cash values- which reduces the death benefit by the amount of the loan- plus interest! Cash Value Lifers say, "If you buy it when you're young- the cost never goes up!" Its a LIE. The cost always goes up! For example, if you pay $100 a month for $100,000 Whole Life for twenty years and take a policy loan to access your cash value (at 7%) - you now pay $100 a month plus 7% interest on the loan... and the death benefit is reduced by the loan amount taken- plus interest! What has happened to the cost? IT skyrockets! If you die without paying the loan back, the loan plus interest is subtracted from what your beneficiaries receive! Can you believe that? It's a FACT! You'd be better off buying a solid 20- or 30-year term policy and investing the difference in your own business, or tax free in a Roth 401 (Solo K)!!

In reality, our needs for Life Insurance Decrease over time...

By buying term life insurance and investing in a separate vehicle, you pay for two things... and get TWO THINGS! You get the maximum life insurance for your premium dollar, and have an opportunity for a better return, tax advantages, and you control BOTH- not one or the other.

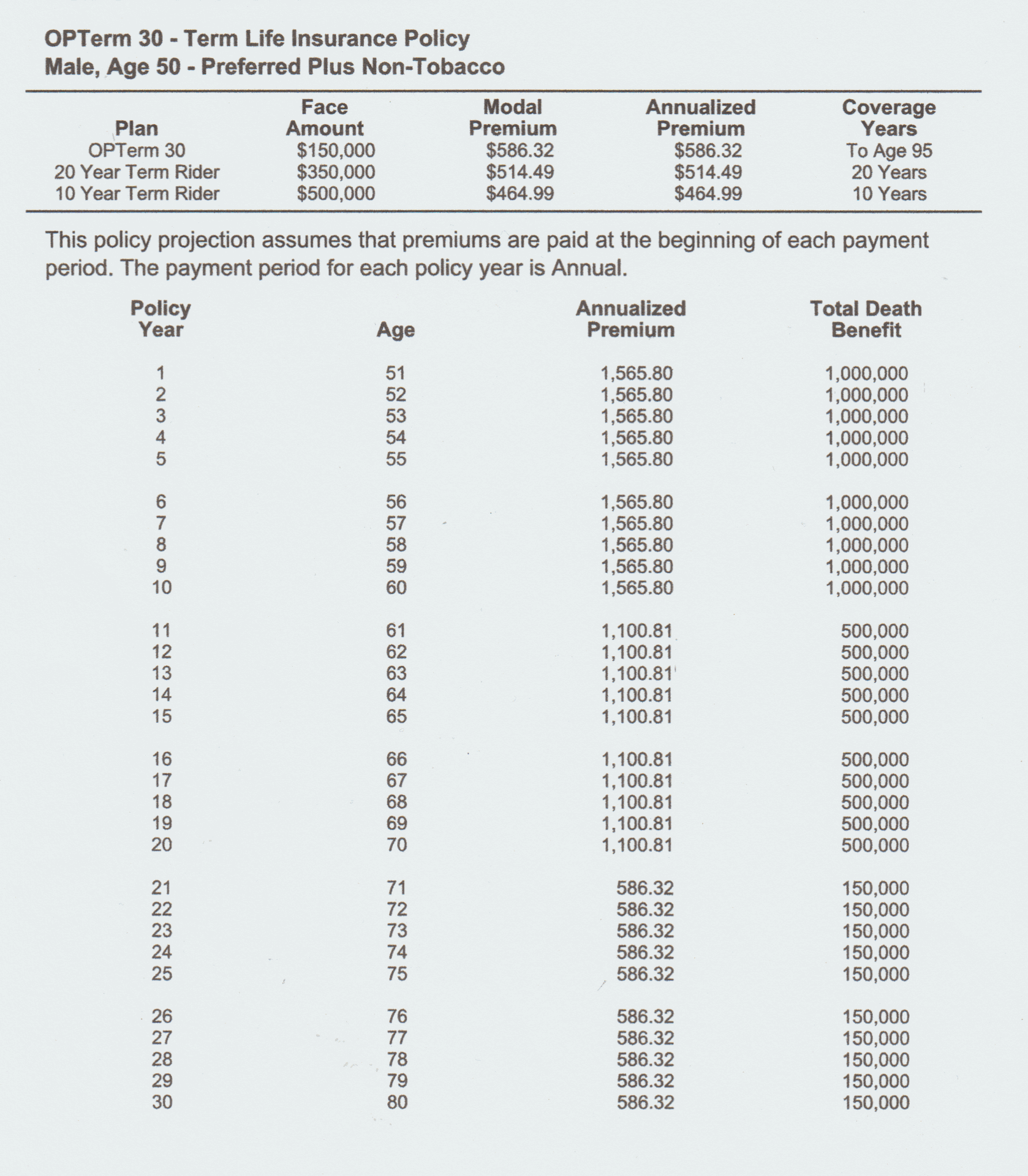

Compare the below structured decreasing term strategy versus paying $200 a month for a 150k Whole Life Policy over 30 years! It pays a 1M Death Benefit saving $900 a year for the 1st 10 years (9k), $500,000 DB for the next 10 years, saving $1300 a year for the next 10 years (13k) and $150,000 DB the last 10 years saving $1900 a year for the next 10yrs (19k)! "Invested at 7% separately, that is worth over $110,000 in 30 years!!! At age 100, its $524,898 when a crappy 150k Whole Life Policy is worth only $150k at age 100!

This IS LIFE CHANGING! (602-344-9012, 575-254-4035, 614-494-0220, 317-245-8058, 517-2481-6935) 30-second quote, 6 Minutes to pre-qualify.

We can help you analyze your needs, illustrate the best possible custom solution (you be the sole judge)- and even implement the plan in 12 minutes or less. Its super simple, not rocket science like 'they' want you to believe it is. Give a me a call and educate yourself at 602-344-9012, 575-254-4035 or shoot me an email: sb@loganhuntergroup.com

-Scott E. Bucher

About Scott:

Scott

brings 30 years of professional Sales/Consulting/Training/Development experience in financial

product sales, sales management, and entrepreneurial development. He holds a BA

in Education from UNM, and a master's degree in management from American Military University. His four and a

half years with the Tom Hopkins Sales/Mgt. Training Organization

and 30 years helping others succeed financially/professionally provides a trove of knowledge transfer opportunities to clients, professionals, and entrepreneurs

alike!

Get a Quote

Call to reserve your 12-minute Power Brief and Free 30-second Quote today! 602-344-9012 or by email: sb@loganhuntergroup.com